Businesses are often structured to protect assets and/or to obtain an accounting or taxation advantage. However, certain commercial structures may have unintended consequences to your businesses’ payroll tax obligations. This is particularly so in more labour-intensive industries. We provide two examples of common structures which have attracted unintended payroll tax obligations.

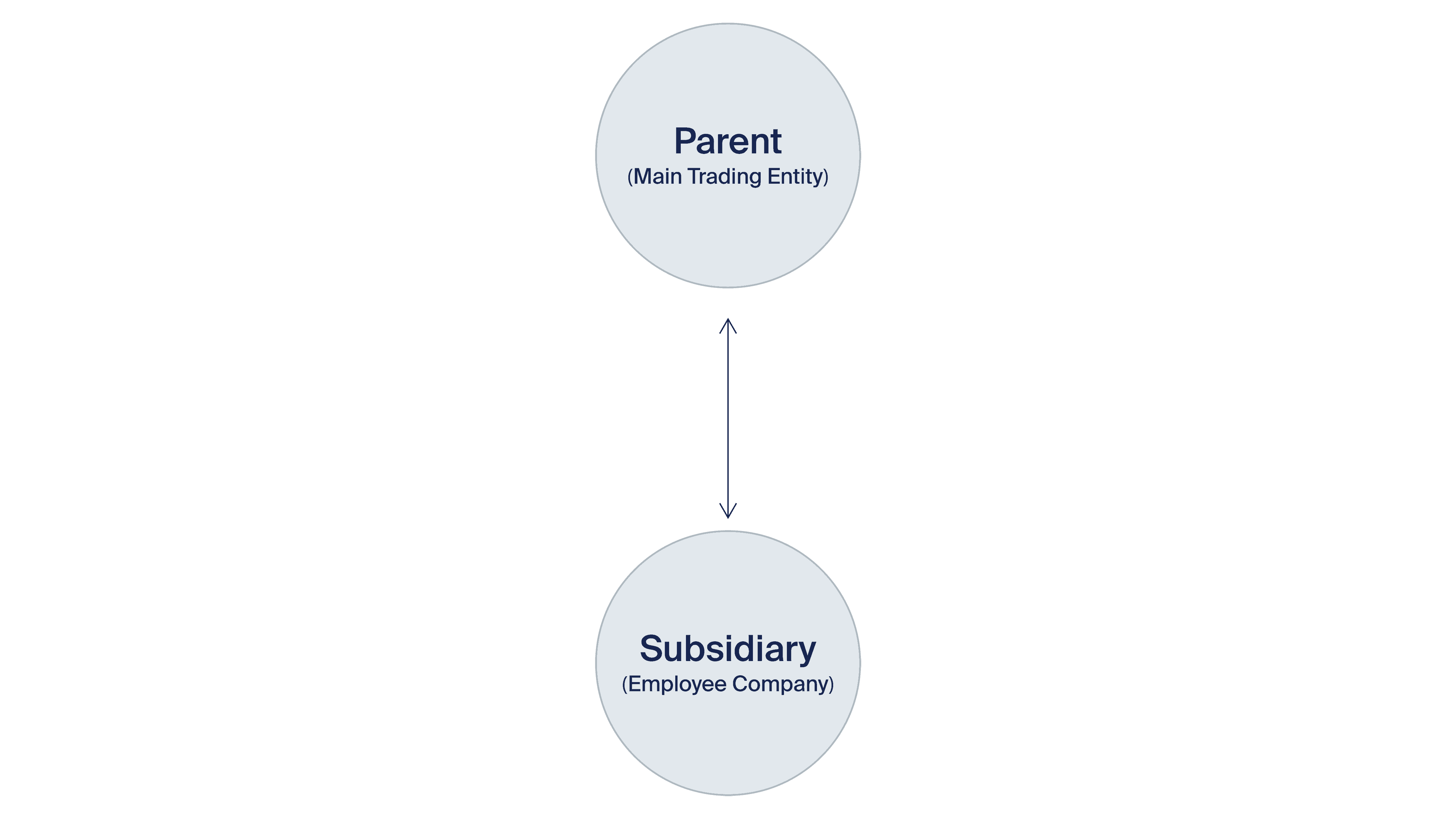

Diagram 1

A parent company (Parent) is the main trading entity that employs the key managerial and administrative staff of the business. The Parent wholly owns a subsidiary company (Subsidiary) and the Subsidiary’s predominant purpose is to employ the majority of labour workers.

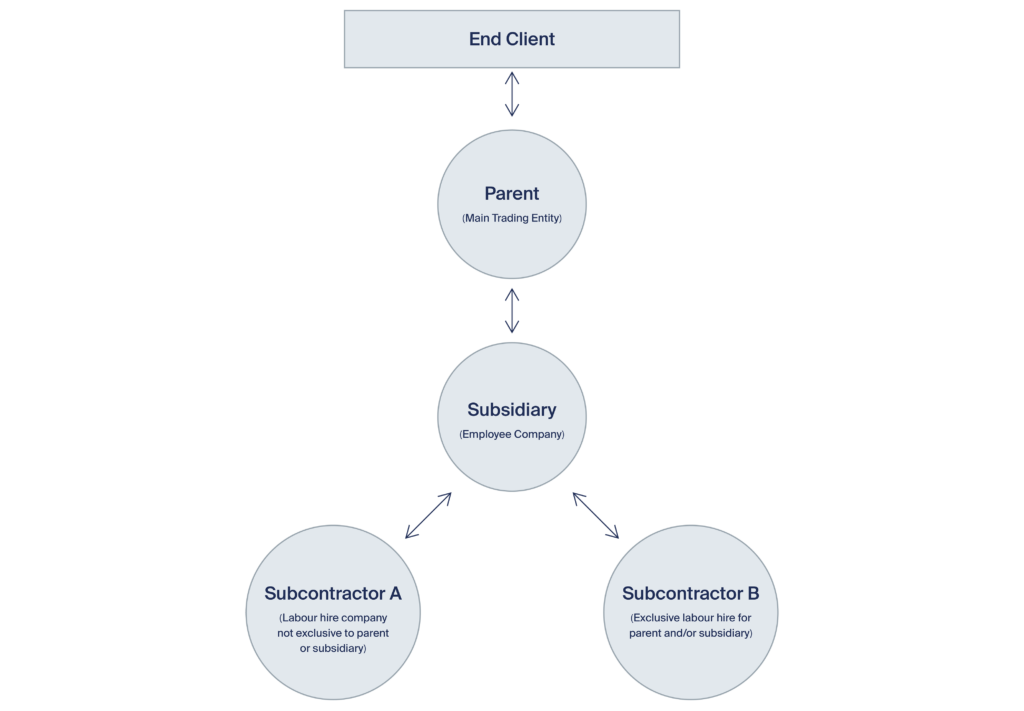

Diagram 2

A parent company (Parent) is the main trading entity (for example, a builder) that contracts with clients for the provision of building material and services. The Parent employs the key managerial and administrative staff of the business. The Parent wholly owns a subsidiary company (Subsidiary) and the Subsidiary’s predominant purpose is to source workers/labourers to the Parent from other entities (i.e. from Subcontractor A and B).

While a company is a separate legal entity, the Chief Commissioner of State Revenue has alternative ways of assessing your business under the Payroll Tax Act 1997 (NSW) (Act) so as to deem the amounts paid to the Subsidiary, Subcontractor A or Subcontractor B for the labourers supplied by each of them as part of the wages ultimately paid by the Parent.

For example, where you have 2 stand-alone entities or employers (as set out in Diagram 1) such that neither companies are subject to payroll tax because they individually fall below the minimum wages threshold, Revenue NSW may group these entities. Once grouped, these entities may become subject to a payroll tax liability if their combined wages exceed the minimum wages threshold.

In Diagram 2, while NSW Revenue may group the Parent and Subsidiary for the purposes of payroll tax, it may also either:

- group with them Subcontractor A or Subcontractor B; or

- deem either or both the Subsidiary or Parent as employment agents such that amounts paid by them for the contractors (e.g. Subcontractor A and Subcontractor B) will be deemed as wages paid by either of them; or

- each of Subcontractor A and Subcontractor B may be deemed as employers of those individual contractors they engage, such that the amounts they pay under the relevant contractor agreements will be deemed as wages paid by them.

Grouping

Grouping provisions are set out in Part 5 of the Act.

The Act seeks to ensure that businesses are not able to decentralise operations through multiple entities so that each of those entities fall under the minimum wage threshold and avoid liability for payroll tax.

Employers and entities will be grouped where:

- companies are related for the purposes of the Corporations Act 2001 (Cth) (e.g. a parent and subsidiary companies, or companies in a corporate group with the same head entity);

- companies that carry on separate businesses use common employees;

- a person(s) has a controlling interest (broadly defined) in 2 or more businesses;

- a person(s) has a direct, indirect or aggregate interest of more than 50% in any corporation; and

- when a business is a member of 2 or more groups at the same time, or the members of a group share a controlling interest in another business.

Consequences of grouping

Where one or more businesses are grouped for the purposes of determining their payroll tax liabilities, a single threshold deduction will be applied to the entire group as opposed to each entity independently within the group. The grouped entities also become jointly and severally liable for the group’s payroll tax liabilities.

On de-grouping

A member of a group can apply to NSW Revenue to be excluded from a group. However, while the Chief Commissioner may determine to exclude a member from a group, he will not be able to de-group related companies. Excluding a member from a group is an option when a business is carried out independently of, and is not connected with the carrying of, a business carried on by any other member of that group. Such a decision will typically depend on various factors, including:

- the nature and degree of ownership and control of the businesses;

- the activity of the businesses; and

- any other matters the Chief Commissioner considers relevant.

Division 7 – Relevant Contracts

Division 7 of Part 3 of the Act imposes payroll tax on payments made under a contract for the provision of services. Contracts that are subject to payroll tax under this division are those in which a person in the course of carrying out his or her business:

- supplies services to another person for, or in relation to, the performance of work;

- is supplied with the services of a person for, or in relation to, the performance of work; or

- gives out goods for re-supply after work has been performed in relation to those goods.

Where a contract is subject to payroll tax, payments made under the contract are deemed to be wages and the parties are deemed to be employer and employees. By way of example, this means that in Diagram 2 above, each of Subcontractor A and Subcontractor B may be deemed as an employer of the individual contractors they engage and supply to the Subsidiary.

Exemptions of relevant contracts

Relevant contracts may be exempt from payroll tax where:

- the supply of services is ancillary to the supply of goods;

- the services supplied are not ordinarily required and are performed by a person who ordinarily performs those services for the public generally;

- the services are provided for a period that does not exceed 90 days or for period in a financial year;

- the services are of a kind ordinarily required by a person for less than 180 days in the financial year. The difference between this exemption and the 90-day exemption is that while the 90-day exemption requires the determination of the number of days an individual contractor provides services to a person , the 180-day exemption requires a determination of the total number of days a particular type of service is required by a person (regardless of whether the service has been provided by contractors and/or employees);

- the services are rendered by a person who ordinarily renders services of that kind to the public generally; or

- the contractor engages labour to perform the work.

A full set of relevant contract exemptions is set out at section 32(2) of the Act.

Division 8 – Employment Agents

The employment agency contract provisions under Division 8 of Part 3 of the Act generally apply to subcontracting arrangements where an entity’s (employment agent) business involves procuring the services of another person (a service provider) for the employment agent’s client(s). Under these provisions, the employment agent is taken to be the employer and the service provider is taken to be the employee. Any amounts paid or payable under an employment agency contract are then taken to be wages, and the employment agent is liable to pay payroll tax for those amounts.

The relevant test is whether the employment agent provided individuals who would comprise, or who would be added to, the workforce to the employment agent’s client for the conduct of that client’s business. When applying this test, the following considerations are usually taken into account:

- the location of where the services are provided;

- wearing of uniforms (e.g. if the workers wear the client’s uniforms);

- if the services performed are in the ordinary course of the client’s business (that is, services necessary for the business, regular/continuous workforce as opposed to particular projects or one-off events);

- compliance with the client’s direction and instructions; and

- whether the services provided could have otherwise been performed by the client’s employees.

Diagram 2 above demonstrates a ‘chain of on-hire’ situation, where an employment agent (Subsidiary) on-hires a service provider to another employment agent (Parent) who in turn on-hires the service provider to its client. Depending on the circumstances, it may be open to Revenue NSW to assess both the Parent and Subsidiary for payroll tax on alternative bases for the monies paid under each employment agency contract. However, Revenue NSW typically assesses for payroll tax the entity that is closest to the client; that is, the Parent.

Exempt employment agent contracts

Certain types of payments that are otherwise made under employment agency contract are exempt under the Act where:

- the wages would have been exempt from payroll tax under the Act had the service provider(s) (i.e. subcontractor(s)) been paid directly by the client as an employee; and

- the client has made a declaration to that effect to the employment agent in respect of the service provider(s).

Organisations that are generally exempt form payroll tax under the Act include:

- non-profit bodies whose sole or dominant purpose is of a charitable, benevolent, philanthropic or patriotic nature;

- public benevolent institutions;

- religious institutions;

- certain private non-profit schools providing education at or below secondary level;

- health care service providers; and

- local councils.

Lionheart Lawyers have a team of dedicated lawyers who can assist you to ensure that your business complies with its payroll tax obligations. Contact us today.